COMPARISON ESTIMATION DOCUMENT REFUNCTION INSURANCE COMPARISON ESTIMATION DOCUMENT REFUNCT

I am the owner of the blog. What is loss insurance?

It is a guaranteed product that can compensate for the hospital’s medical expenses caused by injury or illness.Loss insurance can be compensated up to 50 million won per year for injury and disease hospitalization, respectively.Injury and disease visits are limited to salary, non-salary 200,000 won limit, and non-salary visits are limited to 100 times. What are the top three non-salary items?

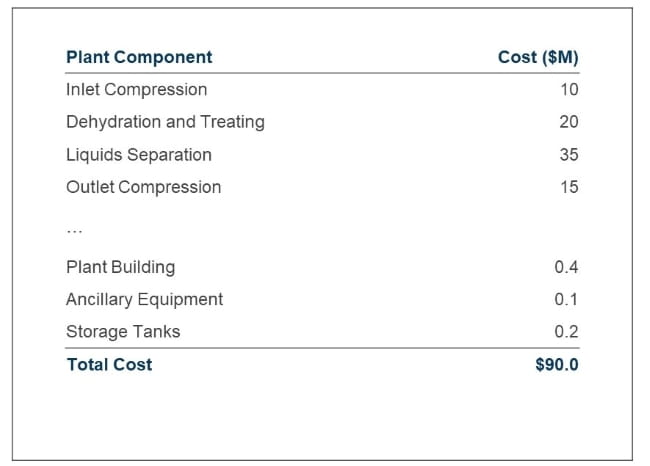

The limit of 3.5 million won per year for frequency treatment is 3.5 million won per year, and the limit of 2.5 million won per year for MRI is 3 million won per year.

loss self-burdenomination

The personal contribution is 20% salary and 30% non-salary.The proportion of self-payment in the salary category is 20%, and the maximum limit is 2 million won.The salary deduction is at least 10,000 won for hospitals, clinics, and pharmacies, and 20,000 won for general hospitals, which deducts large out of 20% of the deduction.The proportion of personal contributions for non-salary items is 30%, and there is no maximum limit.In the case of a non-salary hospital deduction, a large price out of 30,000 won and 30% will be deducted.The ratio of self-payment for the 3rd generation non-salary items is 30%, and the minimum self-payment is 30,000 won.Renewal cycle The renewal cycle of loss insurance is 1 year and the renewal cycle is 5 years. ● Benefits of 4G loss

The advantage of 4th generation loss insurance is that insurance premiums are cheaper than existing loss insurance products.It is about 70% cheaper for 1st generation loss insurance measures, 50% for 2nd generation loss insurance measures, and 10% for 3rd generation loss insurance measures.Due to the separation of salary and non-salary special contracts, the total limit compared to 3rd generation loss has doubled.The combined limit of salary and non-salary for the 3rd generation loss is 50 million won, but the 4th generation loss currently sold is up to 100 million won in compensation for injury/disease, respectively.For the 4th generation loss, the subscription limit on the day of the opening of the contract is restored every year, so there is no 90-day exemption period.Partial compensation for salary has been expanded.In the case of salary items, compensation has also been expanded for treatment items that were in the existing disclaimer.congenital brain disease, habitual miscarriage, infertility, artificial insemination, skin disease, obesity, and hormone administration are also applicable. non-salary premium discount

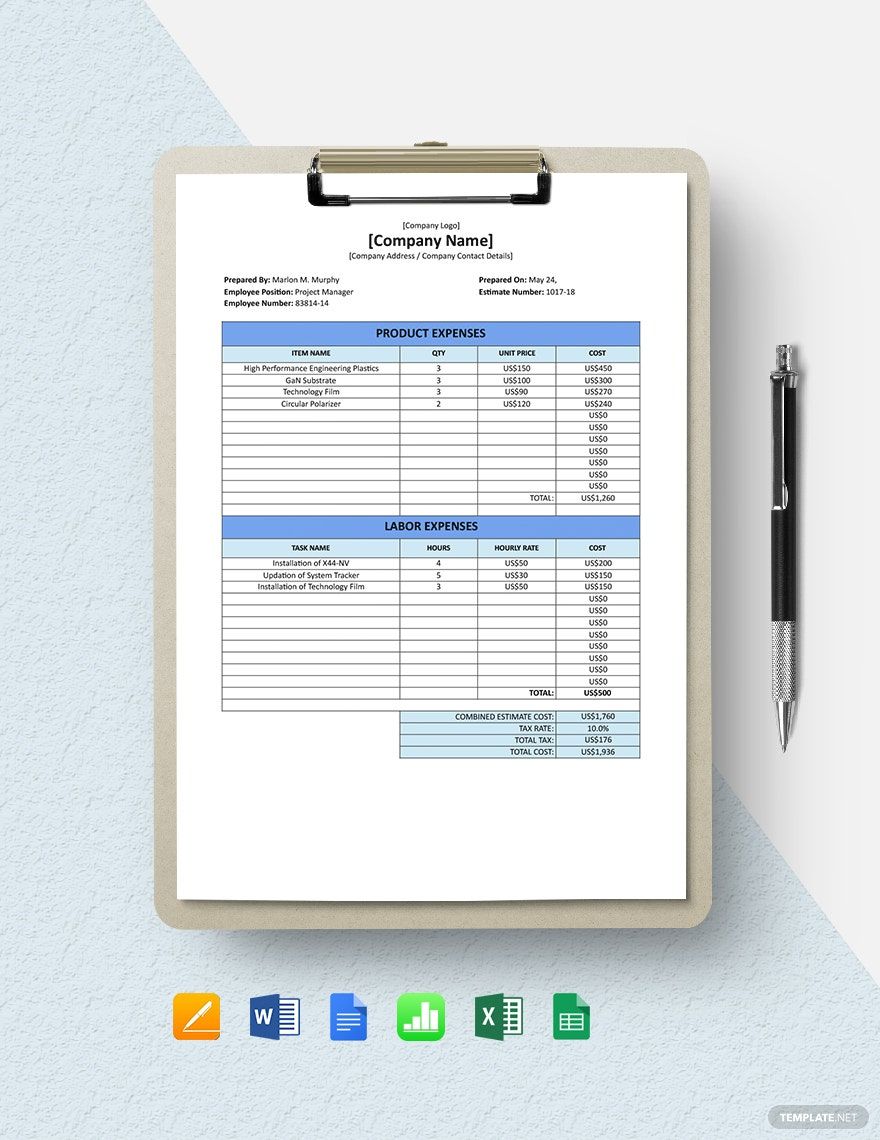

Those eligible for the premium can pay 1.8% of the total subscribers and the remaining 98% can pay a discount or existing insurance premiums as they are.Discounts/increases are not accumulated and are evaluated annually.It is aimed at preventing over-treatment, and there are great advantages for the absolute majority who do not actually receive non-salary treatment.loss medical expense subscription rate loss medical expense75% of subscribers and 25% of non-subscribers, and the average annual medical expenses per elderly person aged 65 or older will be steadily increasing.In 2021, the average medical fee for the elderly aged 65 or older is 5085,000 won, which is not a small cost.There will be no big burden on hospital expenses during economic activities, but it will be a burden during retirement.Illness and accidents come suddenly one day without notice. Measures should be taken in advance to prevent the family economy from becoming difficult with measures against major diseases and accidents and minimum medical expenses. composition of medical expensesUnder 1 million won is 11.5% 1.01 million won to 5 million won 37.3% 5.01 million won to 10 million won 15.1% and more than 10 million won 36.3%. Examples of loss insurance subscriptions15-year-old male student monthly premium 4,880 won 40-year-old male office worker monthly premium 9,005 won 44-year-old female housewife monthly premium 18,265 won If you use the comparison site, we will provide you with a comparison estimate by company.15-year-old male student monthly premium 4,880 won 40-year-old male office worker monthly premium 9,005 won 44-year-old female housewife monthly premium 18,265 won If you use the comparison site, we will provide you with a comparison estimate by company.15-year-old male student monthly premium 4,880 won 40-year-old male office worker monthly premium 9,005 won 44-year-old female housewife monthly premium 18,265 won If you use the comparison site, we will provide you with a comparison estimate by company.Previous image Next imagePrevious image Next imagePrevious image Next image

:max_bytes(150000):strip_icc()/89411-b-complex-vitamins-5b083386ba6177003668e585.png)